How to Get Money Interest Free

By Tim McMahon |

Empty Nest Finances— Downsizing Tips to Increase Your Retirement Budget

The right financial plan is an essential component for ensuring a comfortable and secure retirement. As you shift from a working income to a fixed income, finding ways to help minimize expenses can free up the funds needed to ensure a better quality of life during retirement. Here are just a few of the many options that may allow you to stretch your financial resources to cover your retirement expenses.

Read MoreSave Money During Wedding Planning

Though pricey weddings seem to be the trend for many Americans, rather than blow all that money in one day, if you can cut the cost down you could use the leftover for something more permanent like the downpayment on a house.

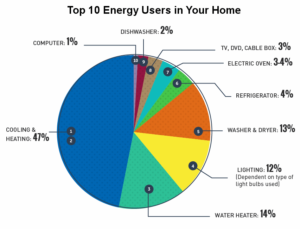

Read MoreHome Upgrades to Save Money Every Day

A home is a major investment. To make the most of our hard-earned dollars, we are always on the lookout for ways to reduce the cost of homeownership. We can explore refinance options, make efforts to improve the value of our home and carry out major renovations and repairs as needed. All of those steps are beneficial and definitely worth the effort, but they don’t have to be the end of the story. There are many simple things we can do that will save us money every single day. Here are four examples of how to upgrade our homes to save money.

Read MoreThe City Life— Tips for Urbanite’s Finances

Living in the city means planning a little more frugally, especially as you are keeping up with the ever-shifting cost of living. If you are not sure where to begin planning for your finances, consider some of these tips.

Read MoreRegular Maintenance Will Save You Money

It doesn’t matter how big your home is or how many people there are in your family – trying to save as much money as possible is just the smart thing to do. Although it may cost you a bit of money upfront, regular maintenance will save you money in the long run. Luckily, there are lots of ways to save money on maintenance without compromising the health and happiness of your loved ones. So, what are some of the most effective ways to do so?

Read MoreHow to Teach Your Children Sound Financial Principles

When children begin receiving money on a regular basis is the best time to start teaching them financial principles. Some kids are given cash or investment certificates by family members for their birthdays and holidays. Allowances may be allocated based on kids’ ability to handle certain chores around the house, like making beds, washing dishes, or dusting furniture. Teens often get part-time jobs while still in high school. Teaching them how to be responsible with earnings will provide key principles for future financial health and success.

Read MoreWays to Save on Basement Renovations

Saving money on basement renovations doesn’t mean that you have to cut corners. You need to plan the steps out appropriately so that you can get what you want within reason. Here are some of the money-saving techniques that you can utilize in your basement project.

Read MoreTips to Quickly and Affordably Sell Your Home

Selling your home might seem like an overwhelming task at first, but If you find it necessary to put your property on the market, here are some tips to help you sell it faster.

Read MoreSteps You Can Take Now to Start Searching for Your Next Vehicle

Getting a car can be an exciting experience; however, it can also be stressful. There are many things you have to consider before acquiring a new one. The amount of money you have in the bank, the price of the vehicle you want and its condition, the plan for your current car, and deciding whether to lease or buy are a few of the factors you need to keep in mind before getting involved with a dealership. It isn’t an easy decision to make. There are a lot of costs and fees associated with a car, so you have to be prepared before making such a commitment. The following steps will help you simplify the process of obtaining your next vehicle.

Read MoreThings to Consider Adding to Your Auto Insurance

A basic auto policy is going to help you cover a variety of expenses if you are ever involved in an accident. While that type of insurance is very important to have, you might benefit from upgrading your policy so that it covers a few additional risks.

Read MoreFamily Finance Tricks to Help You Save Instead of Spend

The growing cost of raising a family has many people looking for ways to save money. However, most folks don’t want to drastically change their current lifestyle just to save a few dollars. Luckily, there are a few simple changes you can make that can save you hundreds of dollars each year without making you too uncomfortable. Take a look at these 4 family finance tricks that can help you save instead of spend.

Read MoreOvercoming High Education Costs

If you want to send your child to one of the best schools, you might have to pay tuition costs. Fortunately, there are ways to ease your financial burden if you’re concerned about the money that’s required to ensure a quality education for your son or daughter. Here are four great ways to overcome your child’s tuition costs.

Read More