How to Get Money Interest Free

By Tim McMahon |

How to Start and Build a Valuable Coin Collection

Almost every youngster dreams of finding a buried treasure. As we get older our dreams may change and we begin to dream of winning the lottery or getting a visit from Publishers Clearing House. While the odds of any of these things happening are rather slim if you know what you are looking for you can discover valuable coins in your pocket change. So, in addition to being an interesting hobby, coin collecting can also be lucrative as well. You most likely won’t find any rare coins right away, but you can build up a valuable and sizable collection over time by simply remaining consistent. Here are a few tips and tricks that you can use to start your own coin collection.

Read MoreConsistency Should Be Your Financial Foundation

While there is something to be said for being spontaneous from time to time, consistency is essential when it comes to money management for your family. Unless you are lucky enough to be independently wealthy and financially secure, budgeting is an essential part of your life. It helps you to determine what you need to […]

Read MoreNewly Weds: 5 Reasons You Need a Financial Planner in the Early Years

Getting married is a joyous occasion, but it also comes with an assortment of questions. One of the biggest is how to handle your money. While you likely previously handled all your finances yourself, now you have to take your spouse into consideration. You don’t need their approval for every penny you spend, but you will need to consult them for larger decisions. Here are some reasons why a financial planner can help out in the early years of marriage.

Read MoreTake Control of Your Future with Self-Directed Retirement Plans

If you’re looking for greater control over your retirement planning and investments, a self-directed retirement plan could be the perfect choice. These plans allow you to choose exactly where and how your money is invested, explore a wider range of investment choices, and decide which assets work best for you.

Read More4 Financial Planning Tips for Parents

Having a baby on the way requires a huge amount of planning. You have to plan all your doctor’s visits, design your child’s room, and figure out how long you’re going to stay out of work post-baby. You might even be planning your meals or researching your childcare options. However, there is one area that many parents forget to plan for – finances. While financial planning might be the last thing on your mind with a new baby on the way, it is extremely important. After all, according to Time, it takes approximately $245,340 in total to raise a baby from birth to adulthood. That is a huge amount of anyone’s income and requires a great deal of forethought to do effectively. Follow these financial tips to ensure that you and your child have the best financial future possible.

Read MoreHow to Save Money on Utilities Comfortably

When money is tight, finding ways to cut back on expenses is important. For many people, one expense that could be reduced are the utility bills. When it comes to cutting back on utility bills, many people are concerned that they will also have to sacrifice their personal comfort to save money. Fortunately, there are several ways that you can cut back on utility costs without having to be uncomfortable in the process.

Read MoreMoney in Your Twenties: 5 Reasons You Need a Financial Planner

The first few years after you graduate from college are some of the most important of your life. You may for the first time have to figure out how to make student loan payments, pay rent and make sure that there is food in the pantry. The good news is that a financial planner can help you create a budget that works today and in the long-term.

Read MoreAre Your Bathroom Habits Costing You? 4 Tricks to Save Water and Keep Bills Low

You would be surprised at how much water your family uses every day. Did you know that the average American uses 100 gallons of water a day? And a good portion of that is just from your bathroom habits alone. The good news is that there are several ways to save water without sacrificing your bathroom habits. If you have public water and sewer (as compared to a well and septic) you may actually paying for that water twice, once when it comes in to your house and once when it goes out. But sewer water isn’t metered so even if you water your lawn with it, you may be paying sewage fees for that water. Plus if you use hot water you pay again to heat it. But you can start lowering your water bills by keeping the following tricks in mind.

Read More4 Ways to Save Money on Internet Service

Internet service is a must-have for the vast majority of households today. People rely on Internet access for all sorts of daily tasks. Parents pay their utility bills on the Internet. Children research homework assignments online. People take care of shopping needs through online retailers, too. If you want to save big on vital Internet service, however, there are numerous convenient approaches you can try.

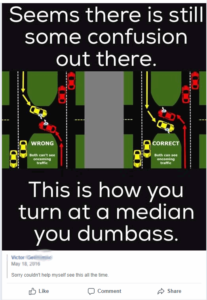

Read MoreDon’t Take Driving Lessons from Facebook

A look at left turn regulations in all 50 states including links to every state’s DMV driving manual.

Read More