How to Get Money Interest Free

By Tim McMahon |

How Much You Should Be Saving for Unexpected Home Repairs

Navigating the unpredictability of homeownership can often feel like steering a ship through stormy waters. Among the many waves you’ll face are the inevitable, and often costly, home repairs. Suddenly, your sanctuary is in need of serious attention: the roof has sprung a leak, the HVAC system has decided to take an indefinite vacation, or the foundations are showing ominous signs of wear. These glitches in your homely haven can wreak havoc on your finances if not anticipated and planned for. In this guide, we’ll delve into the realities of these unexpected home repairs, the importance of creating a safety net, and strategies for smart spending when the need for major repairs arises. This isn’t just a budgeting guide; it’s your compass for weathering the storms of homeownership.

Read MoreTransforming Your Money Mindset for a Brighter Future

Everyone has a money mindset that is deeply ingrained from childhood. Your mindset can either propel you forward or hold you back. If you believe “money is evil” you will sub-consciously sabotage your success when your thermostat says you have too much money.

Read MoreThe Benefits of Downsizing

Discover the financial benefits of downsizing and how making the most of a smaller space can lead to significant savings.

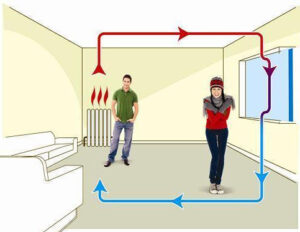

Read MoreWhat Causes Drafty Windows?

With winter coming you may be wondering what caused all those drafts last year and what can you do to prevent them this year.

Read MoreThe Advantages of Home Owner’s Insurance

As a homeowner, you understand the importance of protecting your property. You’ve put countless hours and effort into creating a beautiful and comfortable home—a place for you and your family to live. However, no matter how much time and energy you’ve put into making your house a home, accidents can still happen. That’s why home insurance is so vital. It’s not just about recovering financial losses, but also about securing peace of mind, knowing that your haven is safeguarded against unexpected calamities. Of course, if you have a mortgage, the lender will mandate that you have adequate insurance to cover their investment in your home.

Read MoreLow-Cost Ways to Keep Your House Cool

When the Temperature soars it saps your energy and makes life miserable. So, how do you keep your house cool (without cranking up the A/C and driving your electric bill through the roof)? As a former Solar installer and Energy consultant I learned a few secrets that I’ll gladly share to help make your summers less miserable.

Read MoreInvestment Rental Property Tips for a Competitive Market

Becoming a successful property manager is not an easy task, especially when the market is competitive. No matter where you’re looking to invest, you have to find the right place, build the right structure, and market the property effectively to succeed. You can do this by researching the local rental market, adding popular smart home features, and registering an LLC to manage the property, and using social media to spread the word about the great rental property you have to offer.

Read MoreUnlocking 5 Secrets to Increasing Your Military Income

It takes a special type of person to embark on a military career. It is challenging and rife with dangers and uncertainties, among other things. For those who serve in the military, one of the unfortunate concerns they face is making ends meet, especially given the increasingly high cost of living. Luckily, there are ways to boost your income and create a comfortable lifestyle for yourself and your loved ones. This post will reveal the top secrets to help you increase your military income and unlock financial freedom.

Read MoreHow to Maximize Savings… Without Sacrificing Lifestyle

Yes, savings are critical for a secure future. But you don’t need to sacrifice your joys today for tomorrow’s security. So, let’s change the narrative. Instead, we’ll embark on a journey that redefines savings. Without losing the essence of your lifestyle, this blog post guides you to balance your funds smartly. So, sit tight and prepare for an insightful journey toward a richer future – in every sense of the word.

Read MoreMaking Your Kido an Investment Genius

In today’s world, where the cost of living is always on the rise, it’s essential to educate your children on the importance of investing as a fundamental part of financial literacy. Investing is a valuable tool for creating wealth, generating passive income streams, and securing your financial future. As your kids get older they can learn how to make wise financial decisions and develop the skills to navigate the stock market and other investment options. This blog post will provide some tips on how to teach your kids about proper investing techniques.

Read More10 Tips to Prepare for Your Financial Future

Achieving a secure financial future requires preparation and discipline. By following these 10 tips, you can take control of your finances, build a solid financial foundation, and achieve your financial goals. Remember, start early, create a plan, and stay informed, and you’ll be on your way to a bright financial future

Read MoreProtect Your Home with Home Insurance

As a homeowner, you know just how important it is to protect and secure your home. That’s why having the right type of home insurance can make all the difference. With a wide range of policies available from different providers, it’s easy to find coverage that will meet your specific needs – but with so many different options out there, where do you start? In this blog post, we’ll look into the basics of home insurance and provide tips on what to consider when choosing a plan that best suits your situation. Get ready to feel more at ease knowing you and your family are properly safeguarded against life’s surprises!

Read More