How to Get Money Interest Free

By Tim McMahon |

The Most Overlooked Threat to Your Buying Power

For a long time, the conventional wisdom was to keep 20-35% of a retirement portfolio in cash. Today holding that much cash in the bank or your brokerage account is like a leaky faucet. It leaves your purchasing power going drip, drip, drip. And a bundle hidden under a mattress? Don’t even think about it!

Read MoreSaving Now: How to Prepare Financially for Your Retirement

It is essential to start saving money as soon as you can, in order to have enough money during your retirement. There are many ways to save money for retirement including personal savings accounts, retirement savings plans from your employer, and Individual Retirement Accounts, also known as IRA’s. Take a look at these different ideas for saving you money and preparing for your future the right way.

Read MoreFinancial Planning: Ideas to Get Your Medical Bills in Order

Medical bills are a major issue for people all over the United States, and it isn’t just people who fall under the poverty line who are struggling to pay these expenses. After all, even people who are gainfully employed may find it difficult to pay for an extended stay in the hospital or an emergency surgery that could cost $25,000, $50,000 or even more.

However, medical bills don’t have to be a noose around your neck, and they don’t have to keep you up all night. There are ways you can begin to pay them off and get your finances under control.

Rebalance Your Retirement Portfolio for Optimal Protection

Portfolio rebalancing can be a very effective strategy, particularly with money earmarked for retirement. No one can guarantee the market will come back quickly from a downturn. Retirement investors must protect their principal because they might not have time to recover from a 40-50% drop in their net worth.

Read MoreBe a Good Boy Scout with Your Finances

A single bad market event can have catastrophic effects on your retirement funds so it is important to have safeguards in place to help reduce the possibility of waking up one morning and finding your nest eggs broken. The brokerage community insists that if you are just patient enough your portfolio will rebound but, what if it doesn’t? In today’s article Dennis Miller takes a look at some steps you can take to help protect your Life’s savings.

Read MoreTake Back the Retirement You Dreamed Of

With the current economy some people are postponing retirement for a few years or working part-time during retirement in an effort to pay the bills. No one wants to end up in retirement working at Walmart as a “Greeter” or cashier… so lets look at what can be done to plan for a quality retirement.

Read MoreFinancing Health: How to Plan for Emergency Bills

Paying for unexpected medical bills can be costly and set you back financially if you are not prepared. However, there are some things you can do to minimize the impact of future emergency medical costs and other unexpected expenses. We have put together a list of practical ways you can better prepare for emergency expenses, no matter where they come from.

Read MoreIRS Civil Asset Forfeitures Targets Noncriminals

n addition to the IRS targeting members of conservative organizations it appears that the IRS and other government agencies are targeting ordinary citizens for “Asset Forfeiture” which is another word for outright theft as there is no “due process” involved and the defendant is presumed guilty until proven innocent. In today’s post Matt Chilliak of Live and Invest Overseas describes this latest threat to our “Pursuit of Happiness”.

Read MoreThe Tale of Two Insurance Policies

Are insurance companies just counting on people being ignorant or lazy? Don’t be one of them, be sure to compare prices and coverage before you send any money. In this post we will look at two different term insurance policies and what to look out for.

Read MoreAfraid Your Money Will Vanish before You Do?

The Employee Benefit Research Institute surveys workers each year concerning their retirement confidence. Despite an uptrend, the latest report shows that 82% of workers feel less than “very confident” about having enough money to retire comfortably.

Read More9 Ways to Retire Rich

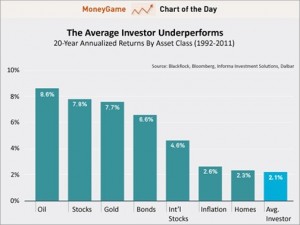

For real people, building a rich retirement requires creative solutions beyond “start saving early.” In today’s post Dennis Miller looks at conventional wisdom and compares theory with practice. He shows that the average investor doesn’t even keep up with inflation (i.e. he actually loses purchasing power with every year that goes by.)

Read More