How to Get Money Interest Free

By Tim McMahon |

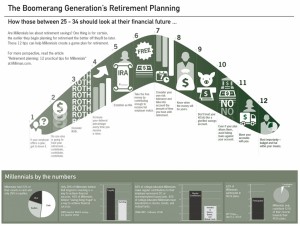

Retirement Planning for the Bommerang Generation- Infographic

Recently, our friends at Milliman Employee Benefits created an infographic on retirement planning for the millennial generation. Millennial’s parents were from the “boomer” generation and because so many of the millennial generation are returning to live with their parents they have gotten the nickname the “boomerang” generation. Of course, if you are living in your […]

Read MoreReducing Investment Stress

Planning your finances and choosing investments can be stressful especially when markets are volatile. But it can be downright scary when like in 2008 they enter free-fall. Many people have decided that the stress (and chance of loss) just isn’t worth it and so they have chosen to stay out of the market altogether. Unfortunately, […]

Read MoreDeciding Who to Trust With Your Money

Almost everything we do in life requires that we exhibit some form of trust. When we go to the grocery store we are trusting that the food is wholesome and the package contains what is says it does. When we go to the gas station we are trusting that the pump is dispensing gasoline and not water. When we choose an investment adviser, a doctor or a lawyer we have to exhibit even more trust because we often don’t even know what we don’t know. So choosing an untrustworthy individual could prove disastrous to our health or wealth.

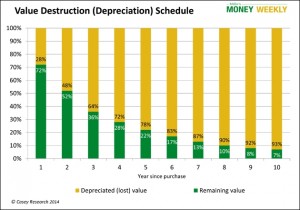

Read MoreThe Real Toll Car Depreciation Takes On Your Net Worth.

Depreciation is the reduction in an asset’s value over time. For automobiles, the first hit comes in a matter of minutes. Drive the car around the block, and it’s no longer a new car; it’s used.

Read MoreAre Annuities for You? Plus 9 Buying Tips

9 Need-to-Know Tips for Buying Annuities… And Knowing When They’re Not For You You’re probably something of an expert in your own field—and that field probably isn’t insurance or annuities. How, then, can you work through the minefield of clauses, guarantees, and pages of small print? Here are nine ways to start. While you may […]

Read MoreGive Your Kids or Grandkids a Financial Boost

Summer is a great time to teach your children about saving money for retirement and an interesting way to do it is by setting up a Roth IRA for them. Remember a Roth IRA is slightly different than a standard IRA. In a standard IRA you contribute pre-tax dollars and so it reduces the taxes […]

Read MoreKey Facts About Your Family Insurance Plan

Every family needs several different types of insurance. Some offer protection for the near term, and some for the long term. Both types are important for protecting your family’s financial future. Make sure your family insurance plans are up to date and will cover the costs of unexpected disasters. Home, Auto, Natural Disasters We buy […]

Read MoreWhy We Lied to Our Kids about Their Inheritance

History tells us that people squander money they inherit or haven’t worked for. And if they don’t squander it, their children surely will.

This is a serious problem for seriously wealthy people. But I believe it’s a problem for middle-class people, as well. Giving money to your children can make them wasteful, dependent, weaken their ambition, strip away their independence and might even make them greedy. So what can you do to help your children learn to succeed on their own and manage money well?

Retirement Guard Duty 101

By Dennis Miller I was just a kid—barely wet behind the ears. At two minutes before midnight, the sergeant of the guard and I marched onto the runway tarmac. Following protocol, I formally relieved the previous guard of his post. This was mid-July at the Marine Corps Air Station in Yuma, Arizona. For the next […]

Read More10 Ways to Screw up Your Retirement

Many well intentioned people make a variety of mistakes when it comes to planning for their retirement. Sometimes you can be subject to forces beyond your control, like a stock market crash, illness, or accident but if you are prepared the effects will be minimal compared to what would happen if you aren’t prepared.

In today’s article Dennis Miller looks at 10 ways many people are sabotaging their retirement without knowing it. Are you making one of these mistakes?

Read MoreEveryone Can Learn at Harvard (Infographic)

The Rising Power of MOOCs: Now, everyone can learn at Harvard (or Yale, or…) 3 years ago, MOOCs were an idea. Now…. 5 million: number of students signed on to MOOCs, around the world 33,000: the average number of students that sign up for a MOOC The Dream: MOOCs Can: • Offer Ivy League Courses […]

Read MoreHow Have Millennials Done So Far? (Infographic)

What Do You Do When You’re 27? Older millennials were blindsided by the recession, and one of the first generations to take out massive debt for school. They are also one of the tech-savviest generations, and attended post-secondary institutions more than any other generation. Lets take a look at how they’re doing — at 27. […]

Read More