How to Get Money Interest Free

By Tim McMahon |

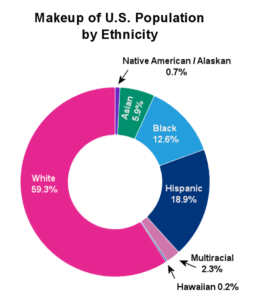

Fifty Years of Reparations and Counting

“Reparations” is a hot-button topic of late, with people on both sides of the issue holding strong (but opposing) convictions. Today I’d like to shed some statistical light on the subject. But first…

Read MoreShould I Keep This Stuff?

Personal Assets: Deciding Whether to Sell Individuals place monetary and emotional value on personal assets such as houses, automobiles, technology, antiques, and collections. While some assets may increase in value as time passes, others may become obsolete or necessitate extensive maintenance and repairs. This article will investigate these aspects and offer advice regarding making educated […]

Read MoreHow to Get the Most Out of Your Auto Insurance

To get the most out of your auto insurance, you need to be strategic in choosing your policy and coverage. Here are some tactics that can help you get the most out of your auto insurance.

Read MoreThe Financial Benefits of Installing Solar Panels

Energy costs are rising, putting additional strain on home budgets, so homeowners are continually looking for ways to cut their energy costs. Installing solar panels is one of the most effective ways to do this. In this article, we will explore the various ways that solar panels can save you money and increase your bottom line.

Read MoreShould You invest in Life Insurance or an Annuity?

What is the difference between investing in a life insurance policy and investing in an annuity?

Which one should be preferred over the other for investment purposes?

Strictly speaking, a life insurance policy and an annuity are like mirror images of each other. A life insurance policy pays a lump sum at death… after a series of smaller payments while you are alive.

On the other hand, an annuity pays a series of payments for the rest of your life after payment of a lump sum at the beginning.

Read MoreWhy is American Cheese so Ridiculously Awful?

The major problem with “American Cheese” is that it isn’t American Cheese anymore. Over the years, it has been diluted and made to be more like plastic, and accordingly, it has been regulated by the Food & Drug Administration and given new names.

Read MoreMortgages for the Self-Employed

Historically self-employed borrowers have had difficulty qualifying for mortgages. Because Self-Employed workers or small business owners typically take advantage of tax code benefits, trying to qualify for a mortgage using tax returns can be very difficult. This type of loan enables self-employed individuals to purchase or refinance a home without having to provide tax returns, W2s, or other forms of documentation that are typically required when applying for a mortgage. Let’s take a closer look at some benefits of this type of loan.

Read MoreWhat You Need to Know About Home Mortgages

Home mortgages are complex financial products, but unless you are independently wealthy they are also essential for people who want to buy a home. Whether you’re buying your first home or refinancing an existing mortgage, understanding the basics of how mortgages work can help you make the right choice. This article will discuss some of the key elements that all prospective borrowers should consider when shopping for a mortgage.

Read MoreHow to Save Money When Moving Abroad

Whatever your motivation for relocating abroad, it is true that the process takes careful planning and research. But moving to another country is definitely worth the effort, don’t let that discourage you. There are many advantages to living abroad, including getting to know new people, immersing yourself in another culture, and depending on the country, possibly a lower cost of living. The US State Department estimates that about nine million Americans are living abroad.

Read More5 Different Approaches to Buying a Car

Are you in the market for a car? Buying a car is an exciting milestone in life, but it can also be a stressful experience. But different people take different approaches to buying a vehicle. That’s why we’ll discuss some of the different attitudes and approaches you can take when going car shopping, and some advice on which approach might work for you. Buying a car is a huge decision, so be sure to take the appropriate amount of time to research and consult before committing to a choice.

Read More5 Tips for Qualifying for an Investment Property Mortgage

If you’re looking to purchase an investment property, you’ll need to qualify for a mortgage. Investment property mortgages are different from traditional home loans. They can be easier or more difficult to qualify for, because they require entirely different types of proof in order to qualify. Here are five tips that will help you get approved for an investment property mortgage.

Read More