How to Get Money Interest Free

By Tim McMahon |

Devastating Budget Buster Or Timely Car Repair?

Even if you have excellent auto insurance, it is still a good idea to set aside a little bit of money every month for car repairs. Although damage can happen in the blink of an eye, often it’s just time, and regular wear and tear that takes its toll on your vehicle.

And having a small emergency fund is going to give you peace of mind knowing that you can handle those repairs without breaking the bank.

Read More7 Ways To Save Money This Fall

With inflation at over 8% in August, it is an important time to begin watching every penny (if you haven’t been already). According to the official government agency tracking prices, i.e. the U.S. Bureau of Labor Statistics (BLS), food prices increased 11.4% from August 2021 to August 2022. Gasoline prices are up 25.6% over the same period. A new car will cost you 10.1% more, and even a used car will cost you 7.8% more than it would have a year ago. And these are the “official” numbers… many believe the actual numbers are much worse.

Read More7 Ways a Tax Lawyer Can Help With Your Personal Finances

You might think that the only reason to contact a tax lawyer is to help prepare your taxes. And although they do that, they also do a lot more. Naturally, they can help you minimize the chance of getting audited (which is a huge benefit) but they can also help you prepare contracts for things like business partnerships and real estate transactions. Since they know tax law inside and out they can probably help you reduce your tax bill by much more than their preparation fee. In addition, they can help you organize your finances to the best effect.

Read MorePrepare For Unexpected Costs When Moving Across State Lines

Whether you’re moving to a new state for school, a new job, or to be with the love of your life, this transition can be both exciting and challenging at the same time. In preparation for your move, it’s important to plan for some of the hidden costs of moving that you might encounter. Whether you move to the state next door or across the country, there may be expenses you didn’t take into account. Let’s look at some of the costs beyond a moving truck and hiring movers that you might not think of.

Read MoreDon’t Skip These 4 Key Areas of Healthcare

When it comes to your health, the old argument of nature vs. nurture applies. Some people may be born with good healthy genes. However, many other areas of health depend heavily on your environment and how well you take care of yourself. With good knowledge, the right tools, and good practices, you can improve the way you look and feel well into adulthood. Good health habits start early and are often ignored by young people. Encourage a healthy household in these 4 areas of health, and it will promote a long healthy life. Here are 4 Key Areas of Healthcare to keep in mind.

Read MoreHow to Stay Within Budget When Building a New House

It’s not easy to stay within budget when building a new house, but with these simple steps we came up with, it might be.

Read MoreGuaranteed Ways to Prepare for a Recession

What’s the Difference Between a Recession and a Depression? Before we learn to prepare for a recession, we might want to know what one is. There is an old joke, “A recession is when your neighbor loses his job, and a depression is when you lose yours”. All joking aside, there has been some discussion […]

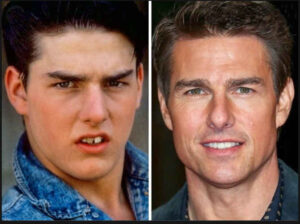

Read MoreHow Much Do Dental Implants Cost? How to Save up for Them

Everyone wants a perfect white Hollywood smile. But, as you can imagine, a movie star set of pearly whites is not cheap. Even Tom Cruise had to go through quite a bit of work to get that perfect smile.

However, a perfect smile is not the only reason to get dental implants; you may need to replace a tooth that was lost to an accident or disease.

If you need dental implants and your insurance does not cover the expense, (and you don’t have a moviestar bank account), you may need to save up for them. Here, we’ll go over some of the details concerning dental implants, and we’ll provide tips on how to finance them.

Read MoreHow to Start Your Own Summer Lawn Care Business

If you love being outside and consider yourself to be good at doing lawn care, you may want to consider opening up your own summer lawn care business. If the idea of going into business for yourself seems a bit overwhelming, however, you shouldn’t worry. Following these steps should help you get started right. Buy […]

Read MoreWhy Personal Insurance Is Essential

Insurance helps you mitigate and manage risk. When you purchase insurance, you transfer the potential cost of a loss of property, health, or life to the insurance company. In exchange, you pay them a fee or a premium. The insurance company will invest your premium and use that money to pay out when there is a claim.

Another way to look at insurance is that it spreads the risk. So rather than one person suffering a devastating loss everyone in the risk pool suffers a small manageable loss via a regular premium payment.

Read MoreOwn a Small Farm and a House? How to Balance Insurance Needs

Farmers are in great need of insurance coverage. Farms are large scale businesses with a lot of money and valuable assets tied up in them. Without the proper balance of insurance coverage, your farm and family’s livelihood could be put in jeopardy

Read MoreFinancial Institutions: Differences Between Credit Unions And Banks

When it comes to choosing the right financial institutions, making the wrong decision can leave you with results that are far less than what you expected. In years past, almost everyone dealt with banks, but these days credit unions are chipping away at the bank monopoly. Here are the real differences between banks and credit unions.

Read More