How to Financially Prepare for Hurricane Season

By Tim McMahon |

Making Smart Decisions When You Need Extra Money

When you’re facing financial troubles, there are basically two solutions open to you. 1) You can find a way to reduce expenses or 2) You can find a way to make more money. There are plenty of tips for lowering costs every month, but bringing in extra money can be a little harder. Here are the […]

Read MoreShopping Tips: More for Your Money

With economies in the gutter around the world, many people are re-evaluating their daily spending habits. Even if you do not want to become an extreme coupon enthusiast, there are ways you could come home from the store with a bit more cash in your pockets. Food and grocery bills are one of the places where people often end […]

Read MoreCutting the Cost of College

The Big Day has arrived. Your bouncing bundle of joy has finally taken his first peek at the world. With the anxiety of pregnancy and labor over, you may be tempted to take a big sigh of relief. However, even after the cost of Lamaze classes, remodeling the man-cave into a nursery and outfitting the […]

Read MoreIt’s ISA Season In The UK

Everyone likes to save money and keep as much away from the taxman as possible, so individual savings accounts are a popular option in Britain. It’s ISA season where banks and other ISA companies dangle great deals and better interest rates in an attempt to woo us to their stock or cash ISA. At its […]

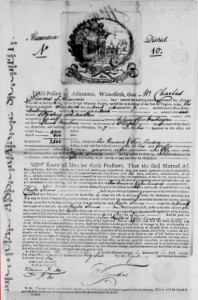

Read More5 Reasons To Update Your Insurance

You don’t have to change insurance companies every time you see a commercial on T.V. promising to save you 15 percent in 15 minutes. However, it’s a good idea to periodically review your coverage because various events in your life can have a dramatic and significant impact on the premiums you pay. Insurance companies are […]

Read MoreTaxes and Freedom

The always-outspoken Doug Casey addresses a broader view of taxation and its costs to both individuals and society in general in this interview with Louis James. L: Doug, the Taxman cometh, at least for most US citizens who file their annual tax papers on April 15. We get a lot of letters from readers who […]

Read MoreIs a Retirement Annuity the Answer for your Retirement Savings?

You’ve probably heard that investment plans and financial schemes like, IRAs and 401 (k), are the best ways to plan for retirement. This might be true in most cases, but not always. For instance if you have invested your maximum contribution for the year to your retirement account and you’re seeking to add a bit more more. What can you do? In this case, among others, investing in a retirement […]

Read MoreDoug Casey on the US Constitution

By Doug Casey, Casey Research Legendary contrarian investor and the original International Man Doug Casey takes aim at the US Constitution, from its sneaky beginnings to its encroachments on individual liberty and free markets. Louis: Doug, we’ve threatened to talk about the Constitution many times. Since there’s increasing interest in the country’s economic and political […]

Read MoreDon’t Cut Corners On Your Home Owners Insurance

By Stefan Mustieles Many of us are looking for ways to shave off a few vital pounds (or dollars) from our monthly bills, without sacrificing on quality. This is particularly the case with recurring expenses such as buildings insurance and contents cover. Buildings insurance covers the fabric of your home. If, for example, a tree fell […]

Read MoreDoing the Roth Arithmetic

By Terry Coxon, Casey Research It’s clear to me, even though it may not be clear to you, that unless there is something very unusual about your situation, if you have a traditional IRA, you should pay the tax now and convert it to a Roth IRA. Not just maybe, but definitely. Not just for […]

Read More