Key Considerations for Smooth Wealth Transfer Planning

Key Considerations for Smooth Wealth Transfer Planning.

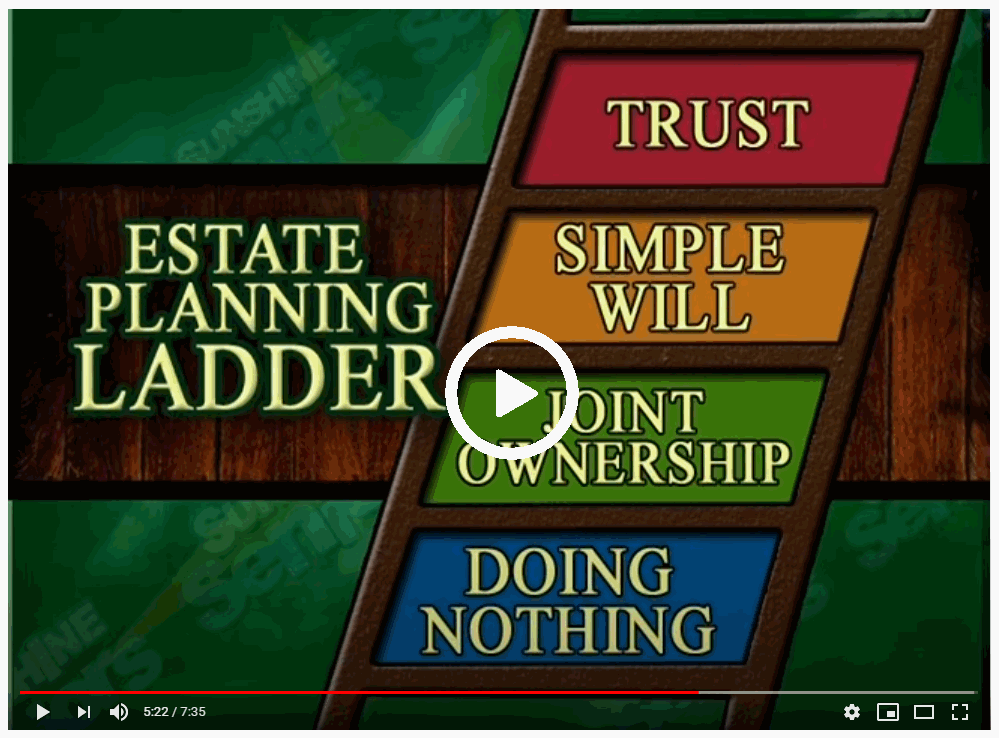

Components of a robust estate plan include a will, trusts, a power of attorney, and healthcare directives. A will specifies how your assets should be distributed upon your death. Trusts, which hold and manage assets on behalf of beneficiaries, can be tailored to meet specific needs, such as reducing estate taxes or providing for minor children. A power of attorney grants someone the authority to make financial and legal decisions on your behalf if you become incapacitated, while healthcare directives outline your medical treatment preferences.

Key Considerations for Smooth Wealth Transfer Planning Read More »