In many parts of the world, bargaining, haggling and negotiating between merchants and shoppers are part of the bazaar experience. Tourists in Marrakech, for example, are warned that refusing to bargain at the bazaar may result in the merchants being offended, packing up their wares and leaving for the day (although this is probably just hype to get you to buy).

In the United States, auto dealerships are similar to bazaars in the sense that salespeople have come to expect price negotiation, but they will be more than happy to not have to bargain. As a matter of fact in 1985, General Motors created a subsidiary called “Saturn” which it marketed as a “different kind of car company” and offered flat rate no haggle pricing. Unfortunately, in September 2009, General Motors discontinued the Saturn brand. More recently certain used car dealers like CarMax have instituted “No Haggle” pricing which supposedly offers you the best deal available without having to work for it. A recent Daily News article on negotiating with dealerships gives some excellent tips on negotiating your car purchase and said, ” Most people hate negotiating face-to-face with dealers. In a recent survey conducted by Accenture, a multi-national management consulting firm, 75 percent of those polled said they would consider conducting the entire car-buying process online if given the chance.”

With the above in mind, here are five secrets that auto dealerships may not want shoppers to know, but they may be willing to accept as part of business.

Market Research

Auto shoppers should start their purchase journey online searching for a car model that meets your needs and has a good track record. Once you’ve decided on the model you are interested in you can start looking at the dealership inventory. Using the inventory search and lookup tools, shoppers will have a solid base for negotiation. Whether you are looking for a local car dealership or one within a particular search area, you can usually do your early research online. Many dealerships actually offer their best “no haggle” pricing online knowing you will be comparing prices with other dealerships.

Should You insist on a Trade-In Deal?

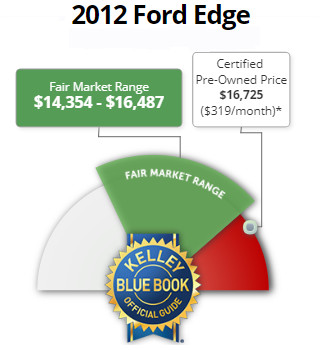

Depending on the dealership, managers may be interested in specific trade-ins for various reasons. But generally they are planning on profiting twice. Once when they give you the lowest trade-in possible and secondly when they sell your vehicle. Often, however, if your vehicle is older they will simply “wholesale” your old vehicle to a company that specializes in older vehicles. The easiest way to know what your car is worth is to check the trade-in value listed on price guides such as Edmunds or Kelley’s Blue Book. You can see from their guides that you will receive much more if you sell your car yourself. Selling yourself generally gets the price midway between what a dealer will give you for a trade-in and what he would sell it for. This can get you thousands of dollars extra. For instance, Kelly’s (KBB) says your used 2012 Ford Edge SEL in good condition with 60,000 miles and standard options should get you a trade-in value of $10,903 but Kelly’s also says you should be able to sell it to a private party for $14,151 or buy it from a “Certified Pre-Owned” dealer for about $16,725 which they note is above the”Fair Market Price” range.

Interestingly, When dealers show a lot of attention towards a certain trade-in model, they may be looking to turn it over as a used car sale or for parts; for example, a Honda Accord from the early 2000s is like gold for auto shops that cater to street racers.

Get a Competitive Edge

Doing online research has an additional advantage in the sense that the internet departments of dealers will listen to shoppers who have already researched pricing in the area. To spark up competition, shoppers should contact the online sales teams of dealers and request prices on at least one make and model.

The next step is to ask if the dealer can do better than the competition. The internet sales departments of dealerships are not typically receptive to haggling unless shoppers bring up hard numbers such as prices from other dealers in the area.

Timing is Everything

Visiting a dealership before closing time tends to yield better results for shoppers who wish to negotiate. Salespeople and finance managers are often eager to go home with the final sale of the day, and thus they may be more flexible and receptive when they listen to proposals. Trying this strategy closer to the end of the month is a smarter move because sales managers are more likely to feel the pressure of moving inventories to improve their monthly numbers.

Don’t fall for the “I’ve got to go discuss this with my manager” nonsense. It is just a ploy to wear you down. The best response is “well if you’re not authorized to make the sale let me talk with someone who is.” I recently walked into a dealer with a printout from the competition and when I showed it to them they agreed to beat the price.

Cash is King

Car shoppers do not have to cover the entire purchase price with cash to get the best deals; showing up to the dealership with a couple of thousand dollars could be even more effective in terms of negotiation.

The reason for this is that dealerships have daily expenses that they need to cover with cash flow so they prefer getting a sizeable initial down payment. When salespeople and their managers know that they have a shopper with cash in her pocket, they will try everything to get her to stay in the lot.

In the end, car shoppers should keep in mind that American car dealerships are like Persian bazaars, and this means that they should not be afraid to negotiate.

You might also like:

- The Family Minivan: 4 Money-Saving Steps to Fix Up Your Vehicle

- Making the Best of the Worst: 4 Tips for Financial Recovery after an Accident

- Avoid the Car Debt Trap

- Simple Ways to Cut Your Car Insurance Rates

- 4 Tips For Saving Enough For A New Family Car

- Selling Your Car? 4 Insightful Ways To Come Out Ahead

- Seven Tricks to Get Your Dream Car

- Asset or Burden? 6 Things About Auto Loans You Didn’t Know

Image courtesy of Jorge Láscar