Higher inflation is causing the cost of living to skyrocket. During such a time, it’s essential to try to identify areas where we can cut costs and put the money saved to better use. Our household bills are the first and most important area to start lowering expenses. Even if we can’t save as much money on those bills as we used to, a different approach could make a significant difference. There are many methods for lowering monthly expenses (both obvious and not so apparent) that you might be overlooking. Here are seven simple yet effective ways to reduce your household bills.

Consider What and How Much You Truly Need

You should ask yourself what you genuinely require and how much of it you require. There are services you cannot go without, such as water, gas, and electricity. Of course, depending on your case, broadband and mobile are some services you might need daily, so you cannot simply cut them out.

However, think about the unnecessary expenses stopping you from building a better financial future. Perhaps you don’t watch as much Netflix as you pay for, or perhaps you don’t even watch the sports channels you pay for regularly. Even when not costly, such added expenses can accumulate and rack up your monthly bills. Furthermore, think about changing the plans you are currently on. You may, for example, not need the highest speed internet available for your everyday needs. Think about your expenses, bills, and subscriptions, and try to cut them down as much as you can.

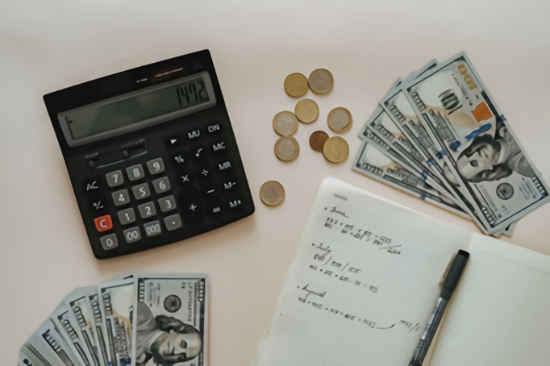

Create a Budget

We’ve all heard about the importance of creating a budget. Creating a budget spreadsheet is one tool that can help you visualize your current financial situation and, in turn, allow you to reduce costs. By taking your income and expenses into account, you will see just where your money is going. Once you have a proper visual representation of your money flow, you’ll know what needs to be tackled. Guide to Creating an Annual Family Budget Plan.

But there is another spreadsheet that only the truly financially savvy use… See the “Bonus Tips” at the end of this article to find out what it is.

However, some factors may make it difficult for you to create a budget. One of the most common ones is relocation. In such cases, proper research is needed. For example, if you’re moving to the Sunshine State, you may research the most affordable Florida cities. Such research will also allow you to choose an inexpensive place that will match your budget and boost it.

Rethink Providers

You may not have the option of choosing which company provides your water, electricity, and gas. However, you can shop around for the best deals for other services like insurance. It is critical to switch providers regularly to increase your chances of getting a better bargain. You may never receive the better benefits that newer customers receive if you stay with the same company for years. Investigate each provider’s various rates and services and select the one that best suits your demands. We recognize that switching providers can be time-consuming. Nevertheless, having a few extra funds in your bank account will undoubtedly benefit you more than hinder you. And although you make get a discount for “bundling services” like auto and home insurance you may actually be better off shopping for them separately since one company may have better rates on car insurance while another has better rates on home insurance.

Haggle When Possible

Make sure you get your money’s worth in terms of services. And if you think this hasn’t been achieved, you might start haggling to reduce the cost of particular expenses. This is one of the best ways to lower your household bills, such as your internet expenses. This is a fantastic option for those who like their current provider and the services they offer but wish they were more reasonably priced.

Once you’ve done the previously mentioned research, you’ll be ready to contact their customer support and inform them you’ve been offered a lower price from a different provider. However, let them know that you’re open to hearing them out before settling a new deal. More often than not, these companies will be inclined to offer better deals. However, make sure you only sign a new contract once you’ve been given one that you believe is a better fit for the money you pay each month.

Save on Doing Laundry

You wouldn’t believe how little tasks such as doing your laundry can affect your household bills. Luckily, there are a few things you may do to reduce these costs:

- Make sure you’re only washing your clothes once you have a full load. You don’t want to have all that water and electricity wasted on just a couple of items. Simply hand-wash items if you are in dire need of them, or wait until you have a full load.

- Only use higher temperatures when washing stubborn stains, your bedding, or towels.

- Air-dry clothes whenever possible.

These simple tips will make a massive difference in your monthly expenses. Saving Money in the Laundry Room

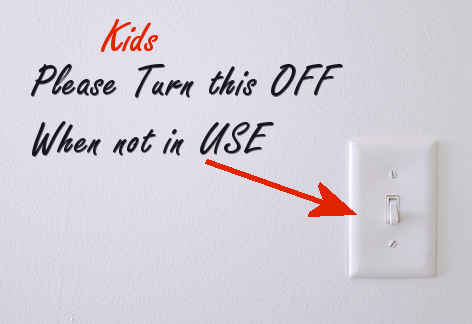

Change Up Your Habits

There are a variety of other everyday habits that might add to the amount of money we spend each month. Many people, for example, may have a poor habit of leaving lights turned on and faucets running. This is a fairly common problem with a simple remedy. Remind yourself daily how much energy and water you are wasting and how much money that will cost you. Also, when leaving a room, close the door behind you. This will prevent hot or cold air from escaping the room, lowering the need for your heater or air conditioner. Your teenagers are often the biggest culprits of such harmful practices. Start them young and instill a budgeting habit in them that they’ll keep as they grow up. Simple Ways to Save Electricity Even a Child Can Understand

Tips to Lower Consumption

There are plenty of other ways to lower your household bills. One method is to unplug all of the appliances while not in use to avoid wasting phantom power. Also, look for energy-efficient ones. You may avoid wasting energy on heating by blocking drafts and lowering your thermostat by a few degrees. Wear more clothes and have blankets strewn about your home if you (or your family members) need help staying warm. You can lower your water heater setting and switch to energy-efficient LED lights to reduce energy waste further. Take shorter showers and use less water when doing dishes to save money on your water bill. Build healthy habits by following these tips, and you will be able to reduce the funds needed for monthly bills. 5 Awesome Energy Saving Ways to Cut Your Home Energy Costs Now

Bonus Tip:

The truly savvy person will follow the example of businesses when it comes to their family finances and track “Net Worth”. Although it is important to know how much money is coming in and going out and where it is going, it is perhaps even more important to know how much is accumulating. Your net worth is assets minus liabilities or how much you own vs. how much you owe.

To calculate your net worth list everything you own in one column and all your debts in another column. Don’t worry you don’t need to itemize every single item, you can just lump them together. When you figure items like furniture and household goods only include how much you could sell them for, not how much you paid for them. So it might look something like this:

Asset Value Liability Value House Value (Zillow) $175,600 Mortgage Balance $130,292 Car $10,000 Car Loan $6,420 Savings Account $5,000 CreditCard Debt $3,847 Checking Account $1,263.57 Student Loan $27,654 Brokerage Account $4,293.23 Personal Loan $4,200 Retirement Account $12,638.68 Total Liabilities $172,413 Cash on Hand $157.28 Assets minus Liabilities $46,539.76 Furniture and Household goods (estimate) $10,000 Net Worth $46,539.76 Total Assets $218,952.76

Note: Over time you should see your Net Worth steadily climbing. If it doesn’t you are doing something wrong. There may be setbacks such as if you lose your job, or have a major illness, but otherwise, you should be paying off your mortgage and increasing your savings and retirement fund. If your Net Worth is negative you need to buckle down and work on that ASAP. You should try to track your net worth every month or two and track your progress.