How to Get Money Interest Free

By Tim McMahon |

Which is Better: New Construction or a Pre-Owned Home?

If you’re looking to buy a “new” home, the question that often arises is should you buy a brand new home or a pre-owned one? Do you want a brand new house that has never been lived in, customized with all the amenities that you or want? Or should you get an older house that may require more repairs and remodeling but may cost less initially and allow you to invest “sweat equity” to improve the value?

Read MoreNavigating Estate Planning and Probate Law

It is an unfortunate fact that navigating the probate process can be very complex, and many people don’t know how to handle a loved one’s estate after they pass away. Luckily, with a little bit of research and some professional legal help, you should be able to quickly overcome those challenges so that you can move on with your life.

Read MoreAre We Switching From a Sellers to a Buyers Real Estate Market?

If there is one constant in life, it is that the real estate market will go through an almost continuous cycle of ups and downs resulting in alternating buyer’s and seller’s markets. With the current uncertainty where is the Real Estate market headed?

Read MoreEssential Investment Considerations for Seniors

As a retiree, you should have been saving for most of your life, but now you have to decide how to allocate your money so it will serve you best. Hopefully, you set aside money from each paycheck either in an employment-sponsored 401(k), stock options, or one of many different types of individual retirement accounts (IRAs). While you might have been saving for the better part of your life, you can’t stop money management once retirement age comes. Unsuspected medical costs, increased taxes, natural disasters, and more can cause a financial burden with little to no preparation time. So you need to plan wisely.

But as retirement time rolls around you might need to make some adjustments to your investment allocations. With some wise investment, you can even be living a more comfortable life as a retiree. Here are some investment options that seniors should consider.

Read MoreWhat to Do If Your House is Sagging?

Foundation damage can seriously affect the value of a home, after all, who wants a house that is “falling down”? If you are considering buying a house with foundation issues you need to be VERY careful. If you have an older home or if your property has experienced severe weather that has damaged your home’s foundation, you are probably trying to figure out how to get the repairs done without paying a huge amount of money. Foundation work can be expensive, so it helps to find ways to save money when planning this type of restoration or repair project. Here are a few tips that can help.

Read MoreThings You Should Know When Investing During Your Retirement Years

You can’t simply leave your financial security up to chance. Throughout most of your life, your goal was to earn enough money to support your family and put a little aside for retirement. But once you have retired, you must have enough savings and pensions to support yourself when you no longer have a monthly salary to depend on to cover your living expenses. Investing a portion of your savings is one way to make your money work without breaking your back. When you’re investing during your retirement years, you need to be more careful and conservative because you no longer have time to recover from significant losses. Here are some tips you should remember during retirement.

Read MoreCheck Yourself: 4 Reasons You Still Need a Checking Account

In this day and age, most adults need to have a checking account, just to keep on top of their day-to-day expenses. You can sign up for one quickly and easily at your local bank or Credit Union. While most transactions are still doable without a checking account, having one can make things much more efficient and convenient in the long run. Here are a few of the top reasons how opening a checking account that will make your life easier. Many in “Gen Z” might think that a checking account is unnecessary since “who writes checks anymore?”. But whether you write paper checks or not you still need a checking account to pay your bills.

Read MoreHow to Handle the Associated Expenses of a Car Accident

No matter how safe of a driver you are, you will probably be involved in at least a few collisions over the years. While those accidents may be minor they can still be expensive, there are a few steps that you can take to cover some of the costs and protect your finances.

Read MoreWhat You Need to Know about Different Types of Homeowners Insurance

Homeowners typically have two options when choosing the amount and level of protection of their insurance policy. There’s ACV or actual cash value and RCV or replacement cost value. ACV will reimburse you based on the initial cost of your home, depreciation considered, which means the insurance coverage may decrease over time. RCV, on the other hand, insures your home for its current market value, regardless of any potential depreciation.

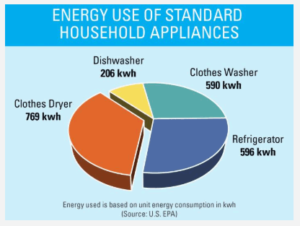

Read MoreTop 5 Essential Home Appliances for Efficiency

If you really want to run a more energy-efficient home, you’re definitely want to look at upgrading or replacing the following home appliances.

Read More3 Storage Methods for Saving Items Safely

Most people have certain items that they need to store securely whether they plan to keep those items at home or at a separate location. Often, the size of their house or apartment and space in attics, basements, or garages affect the decision to keep items at home or at another facility. But there could be other reasons such as only using large items such as fishing boats during a specific season, or keeping certain furniture stored away until a move-in is finished. Whatever your reasons for needing some storage space, there are a few ways you can rent it.

Read More