How to Get Money Interest Free

By Tim McMahon |

6 Keys to Saving for Major Family Milestones

Finding ways to save for major family milestones is essential to successful financial planning. Whether you are funding your children’s education, purchasing a dream home, or embarking on unforgettable vacations, having a solid savings strategy can make these milestones a reality. This article will explore six valuable tips to help you save effectively and achieve […]

Read More4 Reasons Estate Planning is a Must

Estate planning is the process of making plans for the transfer of your assets and properties after your demise. While it may not be a topic that people want to think about, it is an essential aspect of life that must be given due consideration. Estate planning involves the preparation of crucial legal documents such as wills, trusts, power of attorney, and advance medical directives.

Read MorePartner With 5 Experts to Create Your Ideal Personal Finance Journey

Managing your personal finances can be challenging, especially if you are not familiar with earning, saving, and investing a larger amount of money. In the modern world, where financial literacy is crucial, finding the right resources to help you make informed decisions is vital. Partnering with the right professionals can help you get on track and set the foundation for your ideal personal finance journey. This blog post will discuss five types of experts who can help you create an ideal personal finance journey that works best for you.

Read More4 Green Flags When Choosing Insurance

Insurance is an important aspect of our lives, protecting us against unexpected events such as accidents, illnesses, and disasters. It is crucial to choose a reputable insurance agency that provides the best coverage and services. However, with so many insurance companies out there, it can be challenging to distinguish the good from the bad. A good insurance agent combined with a good insurance agency can help you find the right insurance for you.

Read More8 Financial Planning Tips for Growing Families

Growing a family is an exciting journey filled with joy, anticipation, and, naturally, a few challenges. One such challenge is managing your family’s finances effectively. The financial demands of a larger family differ significantly from those of a single person or a couple. That makes managing incomes and expenses for the big bunch an essential exercise. That is where smart money moves come into play. This article will provide eight crucial financial planning tips to help navigate your growing family toward financial stability and prosperity. With a little planning, you can ensure your loved ones a secure, bright future. Explore these tips and gain control over your family’s financial destiny.

Read MoreEmbrace the Golden Years: Navigating the World of Assisted Living With Grace

As we age, we all face the inevitable reality that our bodies and minds will eventually slow down. Tasks that used to be routine may now be more challenging, and we may require extra assistance to maintain our quality of life. It’s ok to admit that you need help, and assisted living facilities can provide the support, care, and companionship you or a loved one needs during their golden years. In this blog post, we’ll take a closer look at the world of assisted living and discuss how you can navigate it with grace.

Read MoreA Comprehensive Guide to Social Security Disability Benefits

This comprehensive guide is designed to help you understand the ins and outs of social security disability options so that you and your partner have the information needed to make sound financial decisions regarding disability insurance.

Read MorePreparing for Retirement: What Is a Gold IRA?

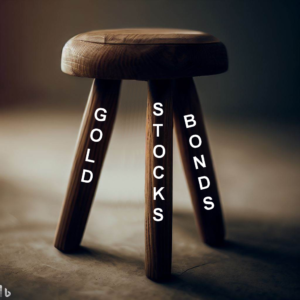

Conventional wisdom says that you need a mix of stocks and bonds because when one goes up the other typically goes down. But what if both go down at the same time (as happened in 2008)? Wouldn’t it be nice if instead of a two legged stool of (stocks and bonds) you could have a 3 legged stool that was even more stable?

Read MoreWhat to Do When You Need a Loan Modification

There are a number of modification programs available, depending on the lender and the type of mortgage you have but you can’t just apply for a modification because you’d like to pay less for your mortgage.

In order to qualify for a loan modification there has to be evidence of hardship, like a disability, job loss, new medical condition, or loss of a spouse. To qualify for a loan modification, you have to be in default (have already missed payments) or be on the edge of default.

Read MoreImportant Tips for Managing Your Family Debt

If you want to pay off your debts, it’s important that you approach the task the right way. So, we’ve put together important tips for managing debt as a family that will help you do it!

Read More6 Tips for Saving Money on Home Repairs

Home repairs can be a costly affair, especially if you are not adequately prepared for them. Whether it’s a plumbing emergency or a sudden need for a new roof, unexpected repairs can throw your budget off balance. However, with the right strategy, you can save big bucks on home repairs and maintenance. Here are six tips that will help you do just that.

Read MoreHow to Sell Your Home Quickly Without Sacrificing Profit

Selling your home quickly without sacrificing profit can be a daunting task, especially in a competitive housing market. However, with careful planning and preparation, you can sell your home in a timely fashion while still maximizing your earnings. This post will explore some essential tips to help you navigate the home-selling process and ensure a successful outcome.

Read More