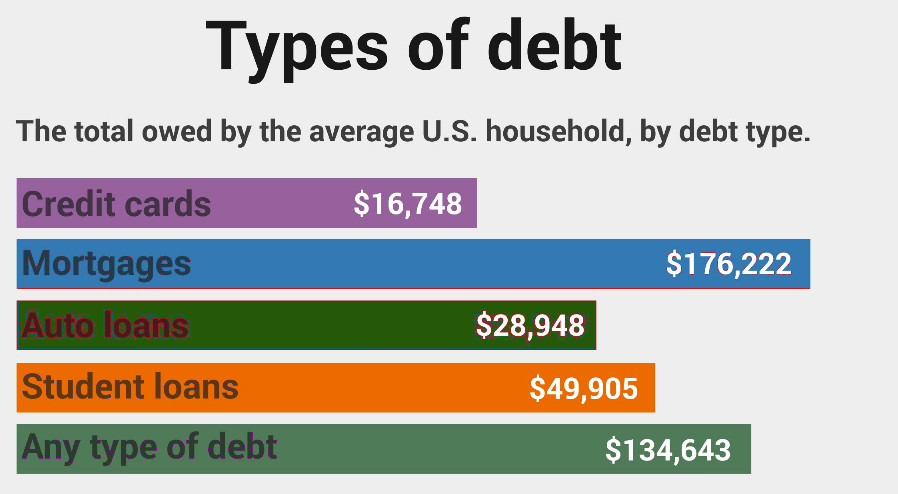

It seems like a national epidemic… One of the biggest challenges that people face today is dealing with their personal debt. According to NerdWallet the average American family has $16,748 worth of credit card debt, $176,222 worth of mortgage debt, plus an auto loan debt of $28,948. All of this is on top of $49,905 worth of student loans (almost $25,000 per adult)!

According to Federal Reserve data in 2014 the Median household income was $53,718 and it rose to $56,516 in 2016. Unfortunately, that is the most recent data we have, but even if median household income rose to $60,000 in 2016 that is a lot of debt to be carrying on that amount of income.