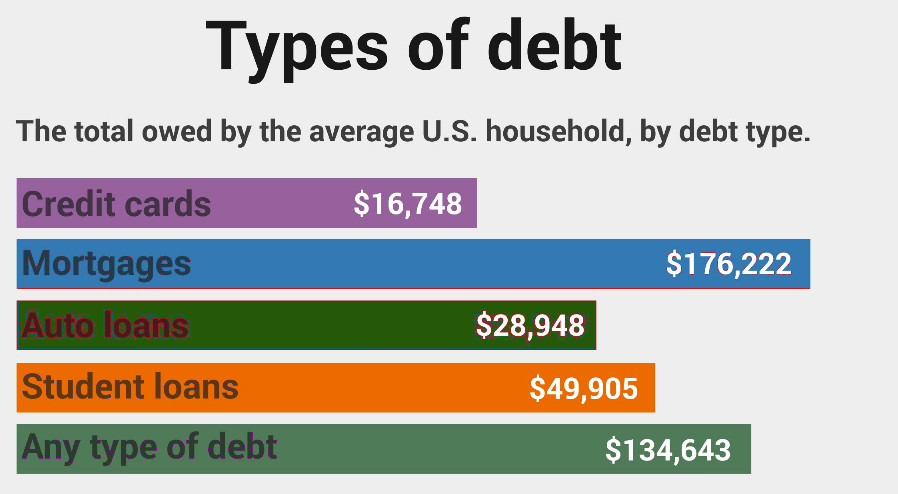

How Does Your Debt Compare?

Household debt continues to accumulate but not for the reason you may think. While spending is at an all-time high, so is the true debt builder: Interest. Interest rates vary across different types of loans, but the sheer amount of the loans makes the interest accumulate to staggering amounts.

How Does Your Debt Compare? Read More »