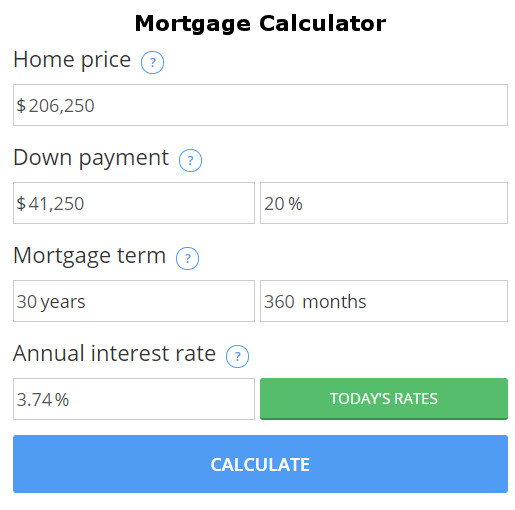

Buying a home is probably the largest purchase of your entire lifetime and one single mistake can easily cost you tens of thousands of dollars. The word Caveat means “Let him beware” in Latin and it is important to remember these Caveats when buying your first home.

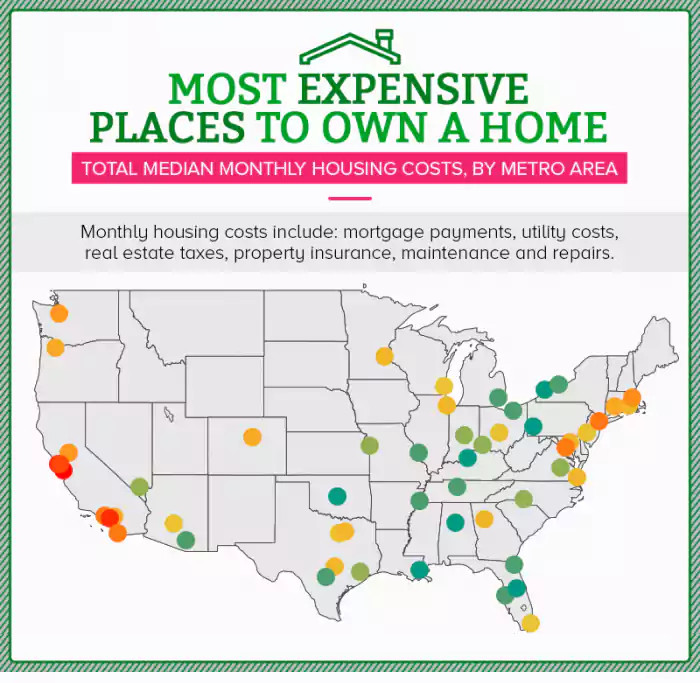

If you are in the market for your first home, you’re probably excited about the prospect of no long living with relatives or no longer making your landlord rich by paying his mortage. However, there are many other issues that you should consider when selecting a property. For instance, you want to make sure that the house is in a nice area close to things that you like or need. What else should you be looking out for?