Planning Your Legacy: 5 Estate Planning Ideas

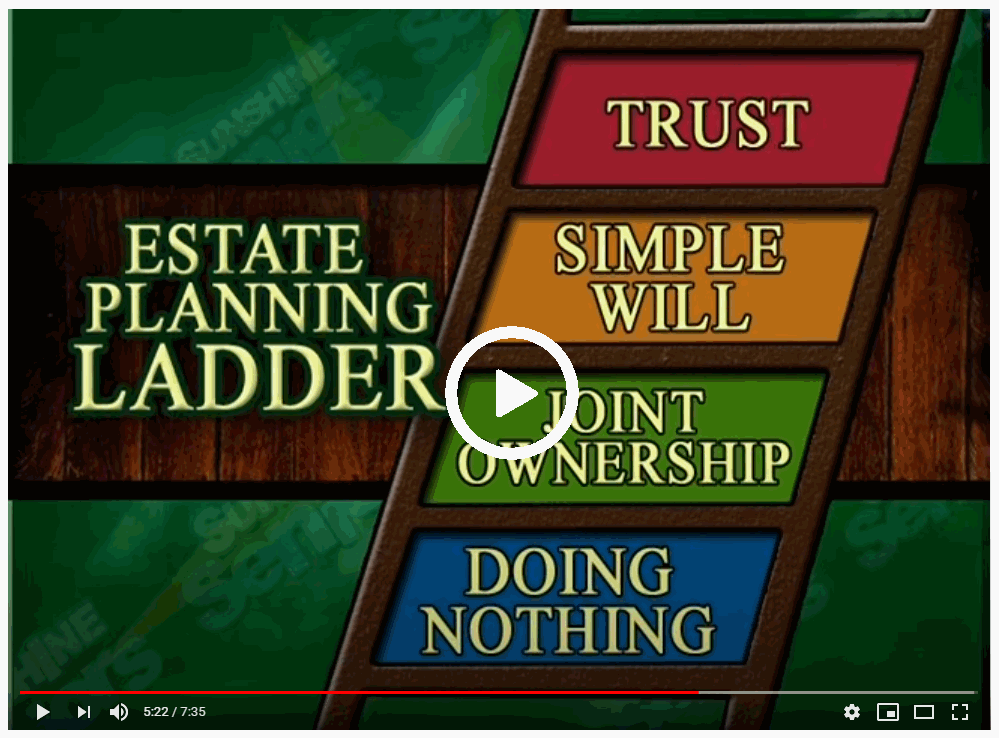

Thinking about your final wishes is never an easy topic to address. Whether you have young children or are nearing retirement, the thought of your death is something most people actively avoid thinking about. However, making preparations for when you’re no longer around is a smart move—especially if you have a lot of assets or property to leave behind. Estate planning isn’t just for super-rich individuals; these tips are essential for anyone who has accumulated wealth and wants to protect their loved ones after they pass. If you’re hoping to leave a legacy after you’re gone, there are several key estate planning ideas that can help keep your family protected and prevent potential issues from arising once you’ve passed away.

Planning Your Legacy: 5 Estate Planning Ideas Read More »