How to Get Money Interest Free

By Tim McMahon |

Hurricane! How to Get Compensation after Significant Home Damage

Hopefully, you’ve survived the recent hurricanes without incident, but with so many people suffering damage from Hurricanes Harvey and Irma you might be wondering how to get compensated if you suffer damage. For instance, suppose you are in the situation of my neighbor David. His roof was about 20 years old and so had about 5 years of life left in it before he was going to have to replace it. But along came hurricane Irma which ripped off about a dozen shingles and created leaks and potential leaks.

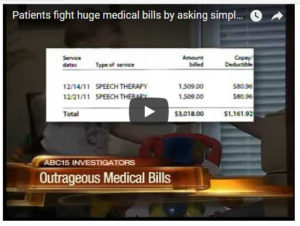

Read More5 Tips for Paying for Medical Bills on a Budget

It is an unfortunate fact that millions of Americans continue to struggle with overwhelming medical bills every single month. Even if you have excellent insurance, you might still be hit with unexpected expenses and fees after visiting the hospital. Here is a look at five tips that will help you pay off your medical bills without breaking the bank.

Read MoreFrugal Living 101

Family expenses can run high, and it may seem challenging at times to stay on budget. After all, there are often home repairs, car repairs, medical bills and more that seem to develop out of the blue. To better plan and budget for unexpected expenses and to continue to live successfully on a tight budget, you need to strategically keep your regular expenses as low as possible. These tips can help you to more successfully accomplish your financial goals.

Read MoreBuyer’s Market: Great Ways to Save Money on Large Home Purchases

One of the least pleasant parts of owning a home is dealing with major purchases. As you slowly pay down your mortgage, your efforts to get out of debt will likely be interrupted by the necessity of making large home purchases. Fortunately, the three methods below can help you to save a bit of money.

Read MoreHome Improvements that Will Pay for Themselves Over Time

When you have extra money to put toward your home, it’s important to choose improvements that earn back your investment either immediately, over time or when you sell your house. Below are seven simple improvements can be done in a weekend or less, and all of them put the spent cash right back into your bank account.

Read More5 Money Habits to Develop Before 30

The best time to invest is when you’re young. Small investments now can grow to be very large and lucrative. If you ask any older adult about investing, they’ll tell you to start as soon as possible because they know what can happen over time. Here are five smart habits that every young adult should be developing.

Read MoreHas Your Family Hit These Money Milestones?

One of the biggest concerns financial planners talk about is the possibility of an impending retirement crisis. Many Americans have very little money squirreled away for their golden years. When it comes to retirement, hope alone won’t cut it. People need to start planning as early as possible for the later years. Here are some money milestones future retirees should begin working on sooner, rather than later.

Read MoreIs Rental Property a Good Option for Earning Extra Dough?

The thought of being able to make money while you sleep is something we’d all like to be able to do. We’ve all heard the fantasy stories of making a million dollars from home. And historically, one of the most common forms of passive income is real estate. And shows on HGTV lead us to believe that it is also one of the easiest to attain. Whether doing a quick flip or having rental property, real estate seems to be the way to go.

Read More