How to Get Money Interest Free

By Tim McMahon |

Are Your Utility Bills Higher Than Expected?

If a pipe is leaking, even if it only looks like a small drip, it could result in significant water usage. According to the USGS Water Science School one drip per second (think Drip… Drip… Drip) equals 86,400 drips per day which is roughly 5 gallons per day or 2,082 gallons per year.

Read MoreHow to Find Appropriate Financing for Your New Vehicle Purchase

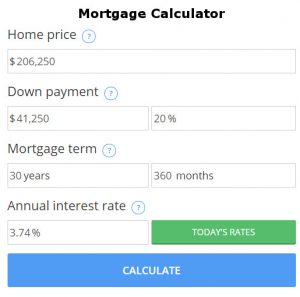

Buying a new (or new to you) vehicle is a fun experience. The feeling you get when driving it off the lot is almost like bringing home a new baby. Unfortunately, unless you’ve followed our advice and saved, saved, saved, in advance… financing is a vital aspect of this process. There are many car loan options in the market today, some are better than others. Finding the right car loan is essential in making a good purchase. Now is the time to start looking at options in your area.

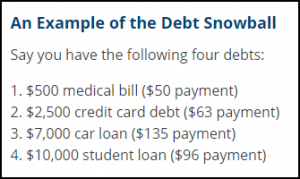

Read MoreWhat to Do When Debt Piles Up

The simple fact is that debt equals stress, especially when that debt keeps growing. Even when you feel that there is no possible solution to your current debt situation, don’t lose hope. Options are available to help you to keep the debt from growing and to get yourself in a better financial position. Here’s what […]

Read MoreInvestments to Consider for Retirement

The two primary purposes of Retirement Investments are: Provide Enough Income to support an acceptable quality of life & Outlast You. Thus the key is to find the proper mix of investments that will meet these two primary objectives.

Read More5 Ways to Finally Break Free of Student Loans

Student loans left over after earning the degree can amount to a lot of debt, and you may be stuck paying it off for years. When you’re trying to organize your finances and eliminate debt, focus on paying student loans first.

Read MoreBetter Way: Money-Wasting Mistakes To Avoid When Moving

When moving day comes you want to have a systematic process in place so that your belongings are loaded and later unloaded without any hitches. But you should also consider the costs involved with moving and the ways you can save money and time just by taking care of a few small details. Here are three mistakes to avoid that can save you money and make your moving day preparation go smoother.

Read MoreHomemade, Natural, Affordable Cleaning Solutions

Are you looking for effective cleaners for your kitchen that don’t cost an arm and a leg? Making your own from a few common household ingredients is the answer you might be looking for. Add the power of a good scent and your cleaners will be better than any commercial product you can find. Here are a few recipes to get you started on saving.

Read MoreDon’t Panic! 3 Stressful Fiscal Issues That Shouldn’t Blow Your Budget

While many major events can result in unexpected expenses and lost wages, these issues do not have to jeopardize your financial future. Major life events can wreak havoc on your personal finances and that is why during ordinary times you should be building yourself a safety net. This net should ideally be six months to one year of living expenses. So if you typically average $3,000 per month in expenses (this includes rent/mortgage, food, gas, utilities, entertainment, everything) then you should have an emergency fund of at least $18,000! (6 x $3,000= $18,000) and preferably $36,000. If you don’t have at least the minimum you are at risk if one of the following events hits you.

Read MoreUnique Ways to Find Extra Cash

If you’re short on money this month, you have options. Here are a few ideas that you can try if you would like to bring in a little bit of extra cash.

Read MorePlumbing Problems: 4 Tips for the Amateur DIY Plumber

Being a first-time homeowner can be both exciting and overwhelming. You can take pride in knowing that each payment that you make towards your home loan is helping you build equity in your home. While building equity is something to be proud of, now that you are the homeowner, gone are the days where you can call your landlord if something goes wrong with the plumbing. It’s now your responsibility to pay for the repairs that you need whenever something breaks down. A good way to save on the cost of the repairs is to learn to do it yourself. If you’re starting to notice that something isn’t right with your plumbing, here are some DIY tips:

Read MoreStrategies To Help You Afford Better Healthcare

With healthcare costs higher than they’ve ever been, more and more Americans are feeling the pinch. There aren’t a lot of easy solutions, although there are some ways you can save. These methods do not involve skimping on care, since your family’s health is too important for that. Here are some strategies to help you afford better healthcare.

Read More