How to Get Money Interest Free

By Tim McMahon |

4 Insightful Ways to Start the Home-Buying Process

The home buying process should be a fun and interesting one whether you are shopping for your first home or have gone through it several times before. The internet, smartphones and virtual tours have changed the way that people shop for homes these days. How can modern technology aid in your home search and provide valuable insights along the way?

Read More6 Tips For Saving Money On Your New Favorite Outfit

You’ve fallen in love with a pricey outfit. Your world will collapse unless you bring it home. Here’s 6 tips for saving on the outfit of your dreams.

Read MoreWhat to Know About Getting a Loan for the First Time

There comes a time in most people’s lives when you find it necessary to go through the process of applying for a loan. It may be for a car, a home, or to help pay for school tuition, but the underlying process of getting a loan is what fuels the consumer economy of the United States. You might not know how to think about this new financial aspect of your budget though, so here are a few things everyone should understand about the American credit and debt industry.

Read MoreSix Investment Types Your Family Should be Making

Building a balanced investment portfolio may sound like a daunting task. But with the abundance of helps, resources, and learning tools available today, this essential task does not have to be stressful. In fact, learning about investing can be fun, especially as you make your first investments, watch your savings grow and your worries shrink! Here are the six basic investment types you and your family should add to your investment repertoire.

Read More5 Mortgage Management Strategies for 2017

The year 2016 was the best of the current decade for the American housing and mortgage markets, but economists are not expecting 2017 to be an encore year in this regard. The strong demand seen in the last few years for mortgage loans will taper off in 2017, and the cost of borrowing money will become greater due to interest rate increases planned by the Federal Reserve. Based on the above, it will be in your best interest to get your mortgage under control in 2017. Here are five strategies you can implement to make this happen.

Read MorePost-Holiday Financial Blues: How To Make A Recovery After The Holidays

The holidays are a strain to most peoples’ bank accounts as they spend money giving gifts and being festive. You’re likely no exception and might find yourself feeling extra stressed out financially once the New Year starts and you realize how the holidays affected your spending and budgeting. Take measures to help yourself recover and get back on track to your goal of being financially responsible by spending less and saving more.

Read MoreMore Than a Fixer-Upper: 5 Major Issues That Will Kill Your Home Sale

Though many people want a move-in ready home, others are willing to buy a house that needs a little work to get a break on the price and a chance to build equity. However, there’s a big difference between a fixer-upper and a money pit so the majority of buyers require a professional home inspection before completing the sale. Here are four major issues that can spook buyers or kill your final home sale price.

Read More7 Ways Today’s Families Can Build and Protect Their Wealth

plan on using wise wealth management techniques to build your estate so you can leave something for your heirs even if you never received anything yourself.

Read MoreAvoiding Common Health Insurance Mistakes

If you’re shopping for health insurance, it’s essential that you select the right plan for you and your family. Health insurance is a very important part of being able to obtain health care at an affordable cost, and if you don’t select the right plan, you could be struggling to find a doctor that will see you or you could be on the hook to pay for the care you need. To help you make the best choices, be sure to avoid the following mistakes when shopping for health insurance.

Read MoreBig Costly Decisions: Are You Ready to Take on a Mortgage?

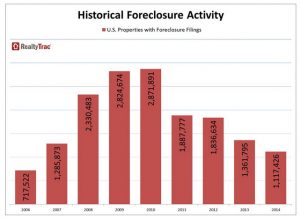

Buying a home is the biggest single purchase most people will make in their entire lives and so it is also an opportunity to make one of the biggest mistakes as people learned beginning in 2008. Up until then the new millenium only included rising home prices and so even a bad deal would come out good if you waited long enough. But then according to RealtyTrac, in 2007 the tide began to turn and over a million foreclosure filings were recorded.

Read MoreThe 4 Kinds of Health Insurance: Which is Best for You?

Health insurance can be a difficult concept to fully understand. Various deductibles, types of coverage, and plan benefits make it difficult to decipher on your own, especially if you aren’t familiar with what everything means. When it comes to coverage in a time of need, your main focus is on the care that is being […]

Read More4 Money-Saving Tips Used By Financial Experts

Whether you’re putting money toward retirement or just scrimping to get by, there are a number of steps you should take to optimize your money’s value. Here are 4 money optimizing tips that the financial experts use.

Read More