How to Get Money Interest Free

By Tim McMahon |

4 More Ways to Pick Up Some Quick Cash

There’s nothing worse than facing an urgent expense with no cash. A few weeks ago we published 5 Easy Ways to Pick Up Some Quick Cash and today we have 4 more ideas for you.

Read MoreHome Maintenance: How To Save Money This Winter

As the temperature drops, your heating bills can soar. According to the U.S. Department of Energy (DOE), heating and cooling your home can account for as much as 48% of your utility bills. But a few simple steps can drastically cut your energy expenses. Here are some tips for home maintenance that will help you save money this winter.

Read MoreBe Sure Your Family is Secure Physically and Financially

As parents, we all want our homes and family to be well protected. Ensuring the well-being of your family is your ultimate goal as a parent. However, we can’t always be present to make sure this happens. As a result, home security systems and certain types of insurance coverage can help to ensure the safety of everyone and everything under your roof.

Read MoreHow to Take Charge of Your Money

People often think that the only way to accumulate wealth is to be frugal and make lots of sacrifices. However, accumulating wealth doesn’t always demand that you live a sparse life; rather, it requires that you use what you have efficiently (waste less) and spend less than you earn (save more). The path to reaching your financial goals starts with understanding how best to put your assets to work for you.

Read More5 Easy Ways to Pick Up Some Quick Cash

Unfortunately, it’s much easier to burn through a wad of cash than it is to make it. Nevertheless, there are ways to make quick cash if you have a bit of creativity. Here’s five strategies to get you started.

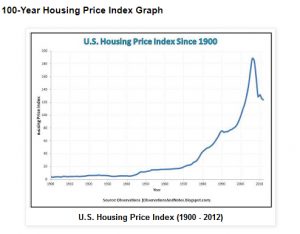

Read More6 Reasons Investing In Real Estate Can Be a Good Idea

Investing in real estate got a bit of a bad reputation during the crash of 2008. But investing in real estate is a great way to diversify your investment portfolio, Here are six reasons why you should consider investing in real estate.

Read MoreRetirement on the Horizon? Financial Tips to Plan for your Future

Being properly prepared goes a long way when it comes to your financial future. Therefore, here are four financial tips to help you be properly prepared for Retirement.

Read MoreHow Air Conditioner Prep In Fall Can Save Money in the Future

Just because the weather is beginning to cool off doesn’t mean your home’s air conditioning system can be ignored in the coming months. A little preventative maintenance carried out in the fall could save you quite a bit of money next spring. Here are some tips for maintenance and saving money on your heating and cooling bills.

Read More6 Ways to Stuff Your Piggy Bank

In the wake of the weakest economic recovery since the “Great Depression”, many paychecks and bank accounts continue to look a bit anemic. Some Americans are still in a position where they can’t even locate money to buy small things they need because their budget is so tight. The following are six tips that you can use to “Stuff Your Piggy Bank” and save some money each month even if money is very tight.

Read MoreCreative Ways to Save on Monthly Expenses

Having a family can be expensive, especially for those with multiple children. The costs of rent or a mortgage, utilities, insurance, car payments, clothing for the whole family, fun activities and school-related expenses can quickly add up. To be able to put away money for your retirement, emergency situations and your children’s college funds, you need to find ways to save money. By finding creative ways to cut costs, you can help your family to be more financially stable over the long-term.

Read MoreThe Personal Side of Retirement

Remarkably little attention has been given to such important questions as the impact of retirement on family relationships, friendships, and sense of self-worth. We know that such personal considerations are key determinants of satisfaction and fulfillment in every stage of life and this includes retirement.

Read More