If losing your personal property to fire, burglary, or some sort of natural disaster doesn’t sound stressful enough, imagine trying to go back in your memory bank to come up with a list of everything that’s missing or destroyed so that you can recoup some of your losses. If you have yet to do a home inventory for insurance purposes, don’t put it off any longer. There’s no better time than now to do a home inventory for your insurance company–and here’s how you can do it.

Get Familiar with Your Policy

If you’re not as familiar with your homeowner’s insurance policy as you probably should be, take it out and review it before you do your home inventory. Take notes regarding your level of coverage, and pay special attention to exclusions. After you do a home inventory, you might find that your existing coverage is less than adequate. If this is the case, you should seriously consider updating your policy so that you have enough coverage for the worst case scenario–a total loss. Doing a home inventory is a great way to find out if an updated policy is in order.

Do a Walk-Through

When you’re ready to start your inventory, set aside a sufficient block of time in which you won’t be interrupted and do a complete walk-through of your home. As you walk through each room of your home, take a video recorder or a camera with you to capture images of your valuables. At the very least, record or photograph the items that would be the most expensive to replace–items such as antiques, collectibles, large furnishings, jewelry, and electronic devices. In addition to walking through each room in your home, be sure to walk through the attic, basement, garage, and shed, if you have them.

Create an Itemized List

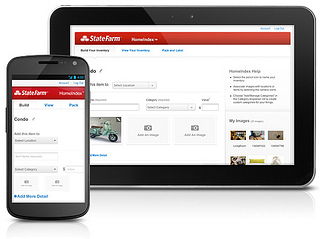

After you’ve done a thorough walk-through, sit down with your video recording or photographs and create an itemized list of your possessions. This can be done by hand, on your PC using a word-processing program, or by using a home inventory program provided by your insurance company. Along with a detailed description of each item, enter in either its value or how much you paid for it, the approximate date you acquired the item, and where you purchased it (if applicable).

Make Copies

A detailed home inventory will be of no use to you if it’s lost or destroyed along with the possessions it lists–so don’t neglect to make back-up copies of your itemized list and all recordings or photographs that go along with it. Safe places to keep back-up copies include a safe, a safety deposit box at your bank, or in the hands of someone close to you that you can trust. You may even want to ask your insurance representative to keep a copy of your home inventory in your file.

Update Your Home Inventory Regularly

Due to the fact that possessions in your home will come and go, update your home inventory on a regular basis–preferably once each year. By regularly updating your inventory, you’ll be able to provide accurate information to your insurance company in the event that you should need to file a claim–and you’ll be able to make smarter decisions when it comes to updating your home insurance needs.

Everyone should have a home inventory safely stowed away for a rainy day–it’s the only way you’ll be able to insure proper compensation if your treasured belongings need to be replaced. Hopefully you’ll never need to refer to your home inventory–but if disaster should strike, the fact that you were prepared will undoubtedly provide you with some much-needed relief.

Photo credit: Inventory Your Assets with State Farm HomeIndex by State Farm on flickr