How to Financially Prepare for Hurricane Season

By Tim McMahon |

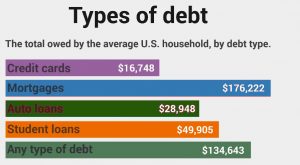

How Does Your Debt Compare?

Household debt continues to accumulate but not for the reason you may think. While spending is at an all-time high, so is the true debt builder: Interest. Interest rates vary across different types of loans, but the sheer amount of the loans makes the interest accumulate to staggering amounts.

Read More5 Financial Tips to Keep Your Children Fed While You’re Out of Work

Losing a job is never fun. It’s bad enough job when you’re single, but it’s a lot worse when you have kids. You worry about how you’ll feed yourself and them, especially if your unemployment stretches on for months. However, you can take steps to keep your kids well-fed while you’re unemployed. Here are five […]

Read MoreSaving on Home Renovations

Renovating your home is often an exciting process but also a stressful one. And one of the most important components of any renovation project is to plan your budget to ensure all the costs are covered. Anyone who has watched any HGTV knows that there are always unexpected surprises that cut into your budget so be sure to allow at least 10% to cover these unexpected expenses. Here are a few tips to help you to save smart and have enough to finish the project properly.

Read MoreTeaching Children While Saving for College

Many adults, find it hard to plan for something that may not happen for another few years or decades. For a child, it may be nearly impossible to comprehend the need to worry about something that won’t occur until they are two or three times as old as they are today. However, it is critical that parents find a way to teach their children while saving for college as part of their mandate to prepare them to become independent adults. This is not simply because of the benefits of getting an education, but the process itself is actually beneficial. If you simply plunk the money down when the time comes you will actually not be doing the best thing for your child and he or she may not appreciate the gift that has been bestowed upon them and thus may actually waste much of the opportunity.

Read MoreFrugal Finances: 5 Ways to Save Money on Home Bills

Home expenses can creep up significantly, often without your realizing it’s happening. Price increases and the growing need for everyday services can eat into your income rapidly. But you can take control of your home expenses, if you carefully review how you are spending your money now, and make a few changes to live more frugally. Here are 5 ideas that can get you started on saving money:

Read More10 Great Educational Family Vacations

One of the best ways to bond with your family and explore new destinations is to take a vacation together. When you want to have fun while having a getaway, it can also be the opportunity to have an educational experience. There are a few educational family vacations to consider taking when you’re ready for your next trip and want to create new memories.

Read MoreWhat to Do When Debt is Burying You Alive

Debt is a serious financial problem. According to Credit.com 80% of Americans are in debt, 44% have mortgage debt, 41% of millennials have student loan debt, 41% have car loans and 39% have credit card debt. While some people are simply spread thin by having too many bills or high credit card payments, others are unable to make the minimum monthly payments. When this happens, you may fall deeper into debt each month, and you may be wondering what steps you can take to re-gain control over your finances or to find relief from your burdensome debt issue.

Read MoreWhy Adding A Mother-In-Law Apartment Could Be a Good Investment Bet

When it becomes necessary for your parents or in-laws to move into your home, you might want to create a space so that they don’t feel like they’re living in the same house as you and your family. It will give them the space that they desire and your family a bit of normalcy while still being able to care for your parents or your in-laws. Before parents move onto the premises, you want to plan ahead by adding a mother-in-law apartment or even an extra room or two to the home.

Read More4 Hobbies That Can Make You Money

Mark Twain famously said, “Find a job you enjoy doing and you will never have to work a day in your life”. By simply “thinking outside the box” you can turn a hobby into a moneymaking enterprise and do exactly what Mark Twain was referring to. Even if it’s something that you do on a part-time basis, you can make money from some of the things that other people see as a way to pass time. When you figure out what you like doing the most in regards to a hobby, you can begin buying more materials or spending more time completing tasks to see how much money you can make.

Read More3 Factors To Consider When Calculating Your Home’s Value

When it comes time to sell your home, you will need to know how much to list it for. However, if you list it at the wrong price point, you risk either getting too little for the house or not getting any offers at all. Many people like to keep track of their home’s value even if they aren’t ready to sell. Knowing your home’s value and subtracting how much you still owe you can tell you one factor in your “net worth” i.e. how much you own minus how much you owe. What can you do to accurately gauge the value of your property?

Read More