How to Get Money Interest Free

By Tim McMahon |

These Numbers Should Make You Mad and Get You Motivated

It seems like a national epidemic… One of the biggest challenges that people face today is dealing with their personal debt. According to NerdWallet the average American family has $16,748 worth of credit card debt, $176,222 worth of mortgage debt, plus an auto loan debt of $28,948. All of this is on top of $49,905 worth of student loans (almost $25,000 per adult)!

According to Federal Reserve data in 2014 the Median household income was $53,718 and it rose to $56,516 in 2016. Unfortunately, that is the most recent data we have, but even if median household income rose to $60,000 in 2016 that is a lot of debt to be carrying on that amount of income.

Read More5 Surprising Ways to Save Money on Household Expenses

Trying to cut down on household expenses is never an easy task. After all, these recurring monthly costs seem never ending. But it turns out that there are few simple changes that you can make that will save you a lot of money over a period of time. Here are five surprising ways to save money on household expenses:

Read MoreHow to Coupon the Modern High-Tech Way

You’ve probably heard fantastic stories of professional “couponers” who descend on a grocery store line with a stack of coupons an leave the store with a truckload of merchandise for a couple of dollars. Although coupons can often mean tremendous savings, getting this level of discount is time consuming and requires almost obsessive planning and organization. Most people like to get things for free or at a discounted price, but they don’t have the time to take couponing to this level. Fortunately, technology has made it a little easier to use coupons and to reduce our everyday expenses without having to be obsessive to do it.

Read MoreCredit Cards Out of Control? 3 Ways to Get You Back on Your Feet

Interest on your credit cards adds up fast. An initial purchase of $1000, with an interest rate of 18%, could take years to pay off, assuming that you make only the minimum payments each month. In fact, if you make even a few late payments the penalties could result in NEVER paying it off, as you’ll see in a moment.

Read MoreMore Than a Price Tag: How to Calculate the Overall Cost of Buying a Home

If only buying a home was as simple as buying a loaf of bread at the grocery store. Life sure would be easier. Imagine the price that you see on a home actually being the price you end up paying. As you likely know by now, that simply is not the case. Depending on where […]

Read More4 Tips For Finding Deals On Everyday Necessities

Finding deals on everyday necessities is much easier than you think. Many are shocked to find they are overpaying for groceries, health services and other essentials. When you take advantage of local deals, coupons, mobile apps and web-based subscription services, you can save money on the items you purchase daily. Check out these great tips to start saving money today.

Read MoreSprucing Up Your Yard On A Budget (Video)

No matter how big or how small your yard, you want it to look great. You might think that this isn’t possible on a limited budget, but there are many things you can do that don’t require a great deal of money. Consider the following ways t0 spruce up your yard when you’re on a budget.

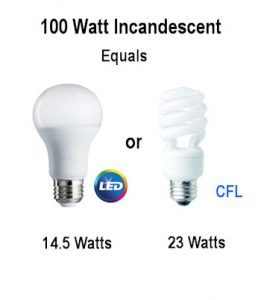

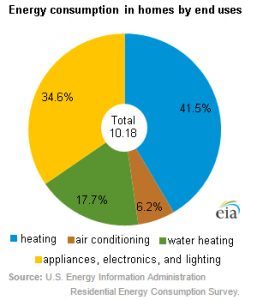

Read MoreEnergy Finances 101: How to Decrease Your Bills By 10 Percent or More!

Next to your mortgage, energy costs are one of your major monthly expenses. The average U.S. household spends about $325 on heating and cooling a month, and that is less than half of your total energy bill… of course this amount varies drastically by location, size of home and individual lifestyle.

It is understandable that families want to cut some of these costs, especially when money is tight. The following are just a few tips to help your family reduce their household bills.

Read MoreUpgrade Your Windows and Save

As much as 30% of your home’s energy energy loss can be due to older single pane windows. If they are drafty and leaky the loss can be even more. So replacing older windows is a project that can easily pay for itself. If you live in a place that requires both heating and cooling new windows can save you money year round. But replacing windows can offer other benefits as well.

Read MoreAvoid the Car Debt Trap

Just because you are in the market for a car doesn’t mean that you have to drain your bank account, or worse yet, go into years of financial servitude… umm… I mean debt. There are many ways to buy the car that you need at a price that you can afford. Let’s look at a few ways that you can still maintain fiscal sanity while purchasing a vehicle.

Read MoreBreak Free, Reduce Stress and Upgrade Your Lifestyle

After spending years on a tight budget, struggling to make ends meet, you finally see a light at the end of the tunnel. With time and hard work, you’re able to move beyond worrying about paying the bills. In fact, you may be at a point in your life where you’re living a bit more comfortably.

Unfortunately, life is a giant paradox… throughout most of our lives we are in one of two situations either we have plenty of time but no money or we have enough money but no time. If you’ve conquered the money problem and are fighting the time problem, how would you like to improve your lifestyle and free up some time?

Read MoreSimple Ways to Cut Your Car Insurance Rates

Everyone knows that it’s illegal to drive without car insurance but why? Well, accidents can happen at any time–which, is why they are called accidents. And because by their very nature cars are dangerous and can cause everything from loss of life to severe financial hardship it is necessary to be sure that an uninsured person doesn’t cause an accident and then say oh sorry I have no money to pay for all the damage I caused.

Read More